Customer Discovery 201: Four Lessons from the Managing Director of a Startup Accelerator

By Angela Kujava (MDM 2023)

October 23, 2023

Angela Kujava (MDM 2023)

Angela Kujava is Managing Director of the Desai Accelerator at the University of Michigan and a current student in ID’s Master of Design Methods (MDM) program. As part of her MDM coursework, she examined customer discovery challenges she’s seen startup founders routinely grapple with, using her professional experience in entrepreneurship as the basis for her research. She has distilled her findings and recommendations into four lessons for entrepreneurs, provided here and on Medium.

Startup Stats

Lesson One: Customer Discovery Can Miss the Mark When It Lacks Design Process

As we all know, most startups do not succeed—for a number of reasons.

According to Forbes, 90 percent of startups fail. And according to Harvard Business Review, more than two-thirds of startups never deliver a positive return to investors.

Despite all this—and my own familiarity and expertise with startups—in 2018, I was surprised that an idea didn’t work out.

This idea was really promising.

A founder experienced in manufacturing developed a software-as-a-service (SaaS) advancement. It could maximize a company’s capacity, reduce manufacturing waste, and dramatically lessen the impact of the industry’s human capital scarcity. Before engineering the product, the founder interviewed numerous production managers in several facilities. He became acutely aware of the challenges faced by the organizations and developed an easy-to-implement solution. It seemed like a sufficiently de-risked bet to me and a number of other investors who supported the company.

Yet the market rejected the product entirely.

What bothered me in this and other cases is how thoroughly it seemed the founder performed customer discovery, only to miss the mark in determining what customers desired.

It’s a pattern I’ve seen for more than a decade.

As the managing director of the Desai Accelerator at the University of Michigan, I coach promising early-stage startups. Most have participated in multiple entrepreneurship training programs before applying to the accelerator. Despite their undeniable preparation and dedication, early-stage founders can exhibit a familiar dysfunction in their startup tactics: their customer discovery efforts, no matter how robust, are largely ineffective in informing decisions that increase the odds of business success.

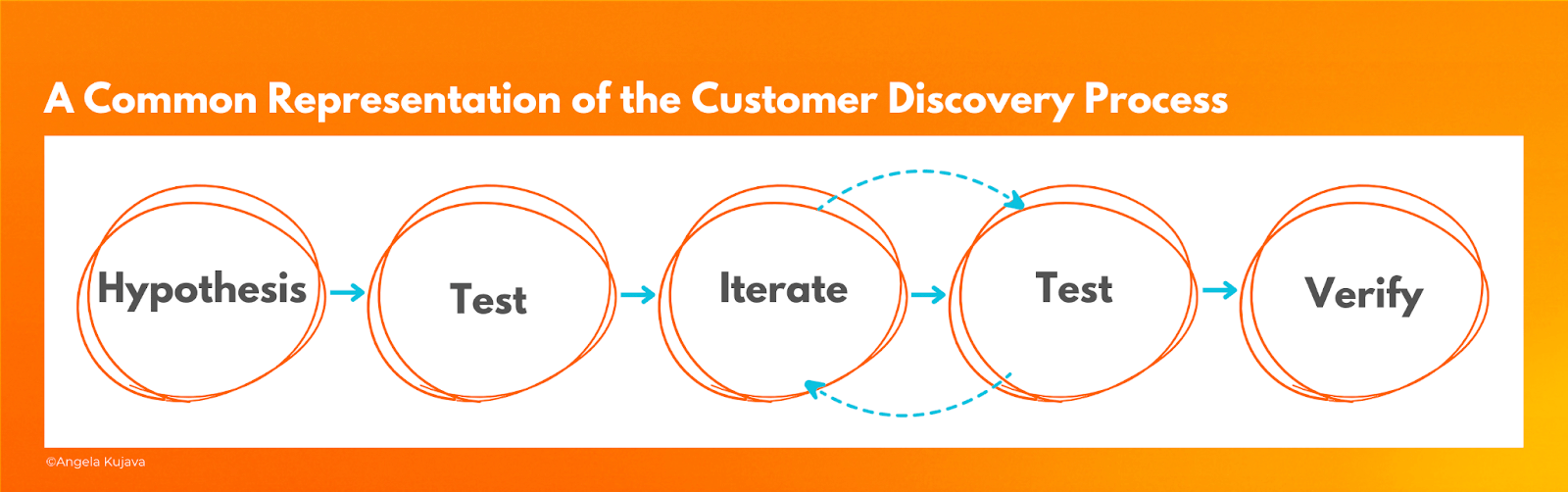

A Common Representation of the Customer Discovery Process

So I decided to examine why this occurs. I looked at friction points, stakeholder motivations and relationships, and other internal and external pressures on founders that affect customer discovery.

And here’s what I found: There exists an imbalanced focus on the different stages of customer discovery.

Coaches, educators, investors, and founders give the most attention to quantifying early activities like interviews and secondary research (“Observation Activities”).

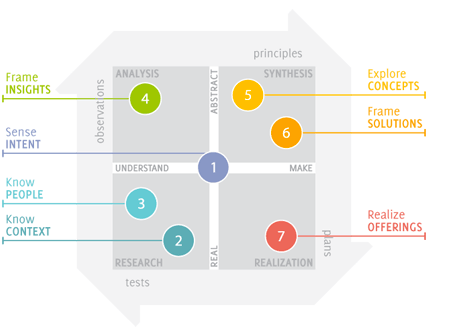

Founders are often asked to report Observation Activities, such as the total number of interviews, total interview hours, number of individuals interviewed, and variety of stakeholder types interviewed. While these Observation Activities are essential, they encompass only a small portion of the research process and don’t convey the quality of the overall discovery performed or process steps that lead to informed action such as insight creation, and information analysis and synthesis. These drive decisions and actions (“Decision Activities”).

The Important Distinction Between Observation Activities and Decision Activities

Looking at this through a design lens, consider the typical representation of startup Customer Discovery versus the Seven Modes of Design Innovation Process from Vijay Kumar’s 101 Design Methods. One could argue that the entirety of the startup Customer Discovery cycle fits into just the Research quadrant of the Design Innovation Process until the Verify stage.

To use a simplistic analogy, consider you’re reading a textbook for my class. You can tell me how many pages you read, the number of chapters you covered, or how many times you opened the book, but that data provides little assurance that you achieved comprehension of the material. Just because you read it, doesn’t mean that you got it or can do anything with it. If instead I also asked you to summarize the important points of the text, compare the narrative with other relevant works, and describe how the author altered your point of view on the main topic, I’d have higher confidence that you appropriately engaged with the material — that you learned. I would also be able to assess whether your interpretations of the material were correct (or at least somewhere on the better end of a spectrum of accuracy when there is no definitive right or wrong).

Presumably, a classroom setting has an expert who “knows the answers,” but in customer discovery, the learner must be the one to generate insights and find the answers. This responsibility may land outside the learner’s comfort zone (and in this setting, the learner is the startup founder in a messy, ambiguous environment) and lead them to focus solely on easily quantifiable Observation Activities. Tracking the number of interviews you did is easy; performing rigorous analysis and synthesis (then reporting the results!) is less so.

While analysis and synthesis are likely well-known to those trained in design, founders may not be familiar with these steps. As Brianna Cohen, co-founder of on-demand patient support platform FindYourDitto, stated: “This is the fundamental problem: we are being told there is a magic number of people to talk to. I interview well, but that doesn’t translate into discovering well. Tell me how to get data-supported information that will help move my company forward.”

Intentionally tracking and evaluating Decision Activities may improve the overall effectiveness of customer discovery. To test this theory, I created a framework that systematizes the tracking and reporting of Decision Activities, which the Desai Accelerator cohort startups are piloting this year.

Next, find out why tracking Decision Activities is worth the extra effort.

Lesson Two: For Startups, Customers Matter Most

Successful innovation happens at the intersection of Feasibility, Viability, and Desirability. To make money, a founder must create something that works and is needed or wanted enough by people that they will purchase it. Yet, I observe a system that often supports founders—while engineering their product or service and in drafting the business plan to monetize it—before the founder has done the work to understand whether people will pay for it.

I believe far fewer resources exist to help founders discern whether a customer truly desires the thing enough to exchange something of value for it.

It’s not enough for a potential customer to say they’ll like a product. It’s not enough for them to actually like the product. They have to desire it so much that they’ll give you their hard-earned cash for it. Otherwise, you have an invention, not an innovation, and you can’t build a business without a path to revenue.

Effective Customer Discovery Is Essential to Business Success

Investors and founders alike believe customer discovery is essential to finding product-market fit, a critical stage in the business life cycle. As renowned investor Marc Andreessen has written:

One can argue that customers are the ultimate arbiters of startup success, and therefore, the corollary: customer discovery must be effective for a business to achieve success.

Aside from potentially catastrophic market risk to the startup, another perilous phenomenon can occur when discovery is flawed.

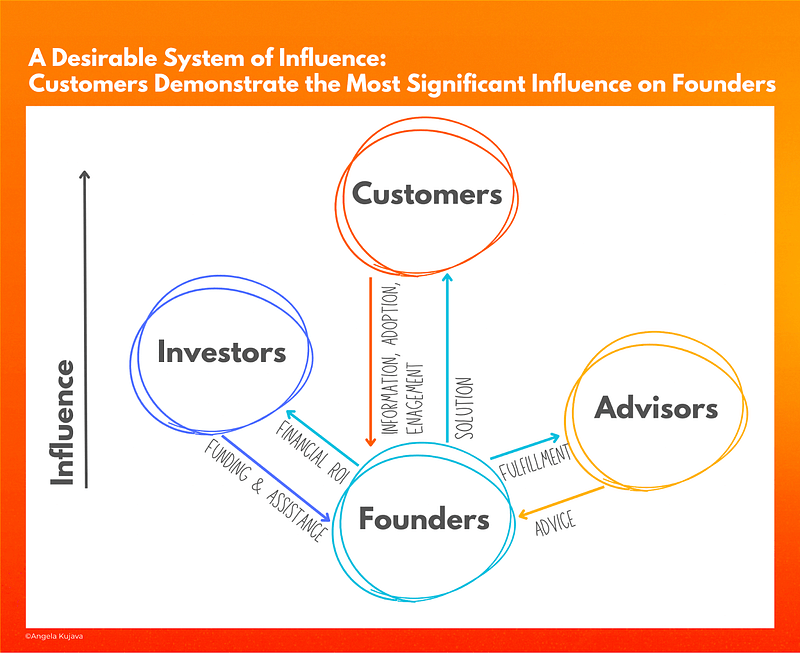

A Desirable System of Influence: Customers Demonstrate the Most Significant Influence on Founders

Flawed Customer Discovery Can Allow Stakeholders Unsuitable Influence

Founders often describe their work as “a calling.” They often commit incredible energy and emotional dedication to their companies. Because it’s also common that startups are frequently underfunded, founders can feel vulnerable to those with outsized means who can help them achieve their goals—namely investors. This can be especially true when the need for financial resources is urgent and alleviates certain high-priority matters (e.g., making payroll).

Investors are an integral part of the startup ecosystem, and many have previously been operators. They have intelligence to share, and founders should seek their guidance (just as investors should provide it when appropriate).

But I’ve seen cases where the founder feels beholden to the investor — whether or not the investor overtly conveys such an obligation — and seeks their direction on product decisions. Unless the investor has created products for the same audience and problem as yours, you are likely to know your customers’ desires much better than they are. And who knows your customers’ desires better than anyone? The customers themselves.

Paradoxically, by allowing the investor undue influence, the founder exposes them to additional risk. To increase their odds of a return, investors seek to de-risk their investments as much as possible. Good investors want to see founders build a Desirable, Feasible, and Viable product, and reporting customer discovery Decision Activities can help them provide an appropriate level of guidance and influence.

Now that we know what’s at stake, let’s consider the various reasons customer discovery goes sideways.

Lesson Three: Reasons Customer Discovery Goes Sideways

I can’t tell you how many times I’ve heard a startup advisor say founders “just don’t want to do customer discovery.” Not only is this not true, but my research suggests that advisors don’t actually believe that sentiment. So why do they say this? Perhaps there is so much frustration with customer discovery because there are many slippery ways to torpedo it.

Cultural Phenomena Impact the Perception, and Possibly Performance, of Customer Discovery

“Fail Fast” is a well-known methodology in innovation culture popularized by Eric Ries in The Lean Startup. While the desire to avoid wasting time on ideas that don’t work is valid, one cannot do all things “fast” with a successful outcome.

What is lost when customer discovery is not given its proper energy? Josh Botkin, advisor to Histosonics and Entrepreneur-in-Residence and faculty at the Zell Lurie Institute for Entrepreneurial Studies, explains, “At best wasted time and effort.”

Not only is the founder increasing their overall risk for the solution’s effectiveness and the success of a business, but they are also exposing themselves to potentially significant opportunity costs in comparison to the effort that would have been spent on discovery.

Some believe it’s not only startup culture that is to blame but a systemic issue of K-12 education systems (in the United States) as a source of a collective urge to jump to solutions before thoroughly studying a problem.

Rashmi Menon, Entrepreneur-in-Residence at the Zell Lurie Institute for Entrepreneurial Studies and faculty at the University of Michigan Stephen M. Ross School of Business, observes that what US K-12 schools teach is to state what you believe and then provide points to back that up .

Founders Experience Many Types of Customer Discovery Process Challenges

During my interviews, founders, investors, and advisors reported a number of friction points that led to defective customer discovery. These fall into four primary categories: problems of Motivation, Rigor, Culture, and Psychology.

Common Customer Discovery Friction Points

Woman conducting interview online.

Ideally, founders perform customer discovery because they want to thoroughly understand their customers’ needs, motivations, emotions, and environmental pressures. However, some founders engage in customer discovery to satisfy an actual or perceived requirement (e.g., completing 30 interviews to receive a completion certificate). Founders may or may not be motivated to dig deeper into the nuances of a problem.

Common Motivation Friction Points

• Satisfaction with superficial evidence

• Asking for opinions rather than facts

• Talking to the wrong people

• Listening to media or investors first

• Choosing to do surveys rather than interviews

• Declining to expand their pool of knowledge

• Resisting new methods of data collection

Lack of rigor takes on many forms and may not be at all intentional on the part of the founder. It is easier to execute a quality interview with comprehensive training, and while the founder may have sought training, the quality of it can vary.

Performing quality customer discovery has a high barrier to entry that you must have the self-awareness to recognize. According to Christina York, founder of Spellbound, a therapeutic tool that uses immersive augmented reality technology to help children cope and engage with medical treatment:

Everybody who is social or good with people thinks they’re good at interviews, and they’re not. We all have our own biases that influence how people interact with us. You have to assume you’re going to screw something up, especially at the beginning of your career. Experience makes you better.

Common Rigor Friction Points

• Not establishing identifiable research criteria or milestones

• Interviewing for opinions rather than facts

• Starting discovery too late

• Neglecting analysis and synthesis of data

• Conflating surveys with interviews

As noted above, startup culture may impede the customer discovery process, but the values of the other communities in which founders operate can also negatively impact discovery. Media, team (internal) dynamics, and investor norms were all noted as areas of friction.

Common Culture Friction Points

• Prioritizing media or investors over customers

• Failing to obtain team buy-in

• Misinterpreting the “fail-fast” ethos

Internal conflict can play a role in a founder’s investment in customer discovery, especially issues of confidence (over- or under-confident).

Common Psychology Friction Points

• Avoiding embarrassment, distress, provocative conversations, or rejection

• Seeking immediate gratification

• Employing performative empathy without genuine humility in the process

With so much working against founders’ pursuit of discovery, it’s no wonder many achieve ineffective results. The good news is that both founders and their advisors are eager for opportunities to improve customer discovery efforts.

Lesson Four: A Framework for Tracking Customer Discovery Decision Activities

Stakeholders in a company (founders, investors, advisors, and customers) are ultimately interested in customer discovery efforts turning into positive results for the business. To understand discovery data, measure it, and report on performance, founders must go beyond reporting customer discovery “Observation Activities,” like “number of interviews” and “types of different stakeholders interviewed,” and report on customer discovery “Decision Activities”.

I suggest three Decision Activities.

Decision Activities

1. Rigorous Analysis and Synthesis

With so much focus on data gathering, stakeholders must maintain sight of how they process that data. Quantifying these sessions and the findings in these sessions may allow for trend analysis and identification of opportunity and challenge areas for the team.

Founders may not be familiar with the terms “analysis” and “synthesis” as they pertain to research, but they’re certainly doing some of this work. I suggest founders understand two or three broadly applicable frameworks (e.g., 2×2 analysis, clustering and affinity mapping, POEMS) and when to use them to evaluate their discovery data.

2. Powerful Insights

I often see founders conflate observations with insights. Insights are more powerful than observations because they include important context about the customer. Insights help founders make informed decisions and prioritize actions.

The designers of VentureBlocks teach that “an insight is comprised of a need and the why. In other words, an insight is a statement that basically identifies a need but also articulates why the need is important.”

Probably just as helpful, they give guardrails on what an insight is not.

Incorrect insights:

- Don’t identify a need that users have;

- Don’t connect the need to the data;

- Misidentify a solution as a need.

3. Informed Actions

Understanding how a founder analyzes and synthesizes data, forms insights, and then uses that information to make business decisions is a strategic three-legged stool. It can demonstrate a founder’s judgment, business logic, coachability, and more. It provides a wealth of opportunities for meaningful and specific discussion about the factors that move a business forward.

Knowing the steps you can take to better serve your customers is only part of the battle. Startups can experience many barriers to implementation, including resource issues and competing priorities. By reporting on the implementation of informed decisions, you are forcing a prioritization of customer needs in the context of company constraints.

Piloting the Decision Activities Framework

Ultimately, I have engaged in this research to investigate whether there is a potential intervention to the challenges I see with customer discovery in my own startup ecosystem. As the managing director of a university-supported startup accelerator, I have a unique opportunity to ideate, test, and iterate an outcome-tracking system with a small, tight-knit population.

We’re doing it now. Each of the five companies in the Desai Accelerator’s 2023 cohort performs customer discovery monthly and reports on the process, insights, and resulting actions. They’re familiar with the following analysis and synthesis frameworks:

- Stakeholder mapping

- Thematic clustering and affinity diagramming

- AIEOU/POEMS/AAAA

- 2×2

- Modeling

- Decision Tree

On a brief form, founders note the needs they observed, who experiences the need, why and how they’re experiencing it, and how this information is new and relevant to the business. They’re responsible for sharing decisions from the process and the resulting actions with priorities, progress metrics, and deadlines.

We’re two months in as of writing this. I have my discovery to track as we go.

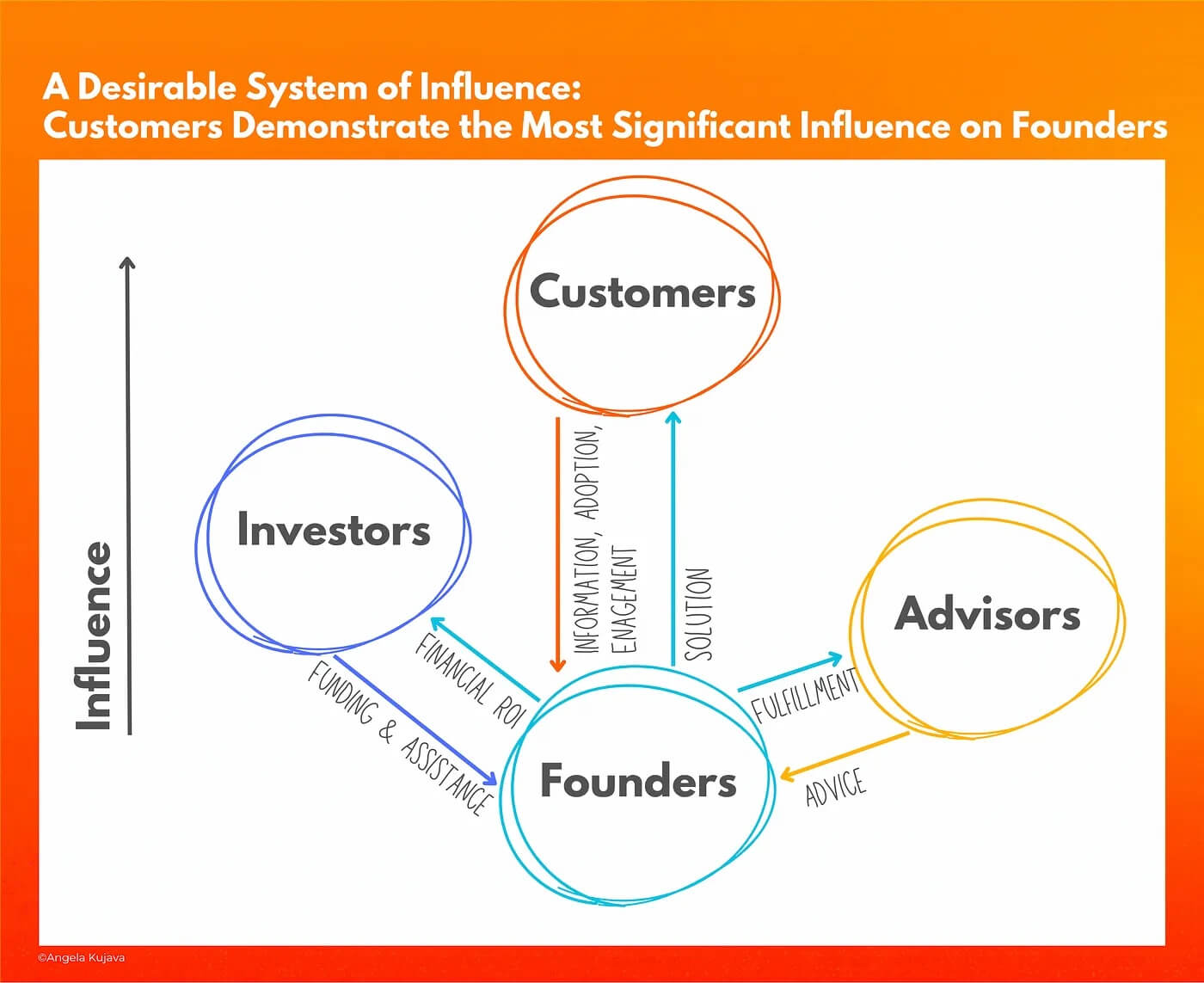

A Desirable System of Influence: Customers Demonstrate the Most Significant Influence on Founders

Other Potential Benefits May Be Achieved Through Tracking Decision Activities

Though arguably not as sexy, there are upsides to tracking Decision Activities beyond increasing the odds of business success.

Tracking Decision Activities also:

- Mirrors Familiar Methods of Performance Measurement That May Increase Adherence

Founders are often expected to provide performance reporting with specific metrics to internal and external parties, such as financial pro forma, customer acquisition costs, and user growth. Investors, grantors, accountants, and other parties often require regular reporting by founders. Reporting Decision Activities replicates that familiar experience. - Provides Opportunities for Engaged Guidance from Investors and Advisors

Just as founders can make better-informed decisions with high-quality data, so too can advisors and investors provide better advice when they understand how and why founders act upon information. Founders may benefit from more detailed advice and earlier identification of missteps. Additionally, they will be able to provide investors with more concrete evidence of a path to product-market fit and invite those investors to participate more deeply in that process. - Removes Stigma Associated with Refuted Assumptions and Change

Formalizing the reporting of learned insights and how they inform business decisions intrinsically welcomes the notion of change. Having one’s assumptions refuted becomes a positive outcome because it means you successfully heard your customers. It’s great to be wrong if understanding why your assumptions are incorrect leads to a better connection with the people who matter the most. Reporting Decision Activities may help reduce the stigma and anxiety of a misfire. - Supports an Appropriate Balance of Stakeholder Influence

Measuring outcomes intensifies focus on customer-informed decision-making, generally considered the most direct path to product-market fit. The customer’s significance is kept appropriately at the forefront, which should help to maintain a desirable balance of stakeholder influence. (For more on the balance of stakeholder influence, see above, Lesson Two: For Startups, Customers Matter Most).

I deeply respect the challenging path startup founders choose and hope this framework can reveal some important innovation signposts early in the journey.